What is Prosper Loans?

Prosper Marketplace, Inc. is a great platform and a good marketplace lending company that offers unsecured personal loans. One must take note that Prosper Loans, however, is not a bank and let you loans of up to $40,000 for any purpose such as Debt consolidation, home renovations, major life events, or any other large purchases. Also, with this platform individuals can either invest in personal loans or else request to borrow money.

It is a San Francisco, California-based company in the peer-to-peer lending industry and one of its subsidiaries is Prosper Funding LLC which operates on Prosper.com. Prosper has also provided over $14 billion in loans to more than 870,000 borrowers, so in other words, you can say that it is an established leader in the peer-to-peer lending industry.

How Does Prosper work?

With Prosper Loans, one can easily borrow in the middle of $2,000 and $35,000 on Prosper for virtually any reason such as Paying off other debt, your wedding, buying a car and much more.

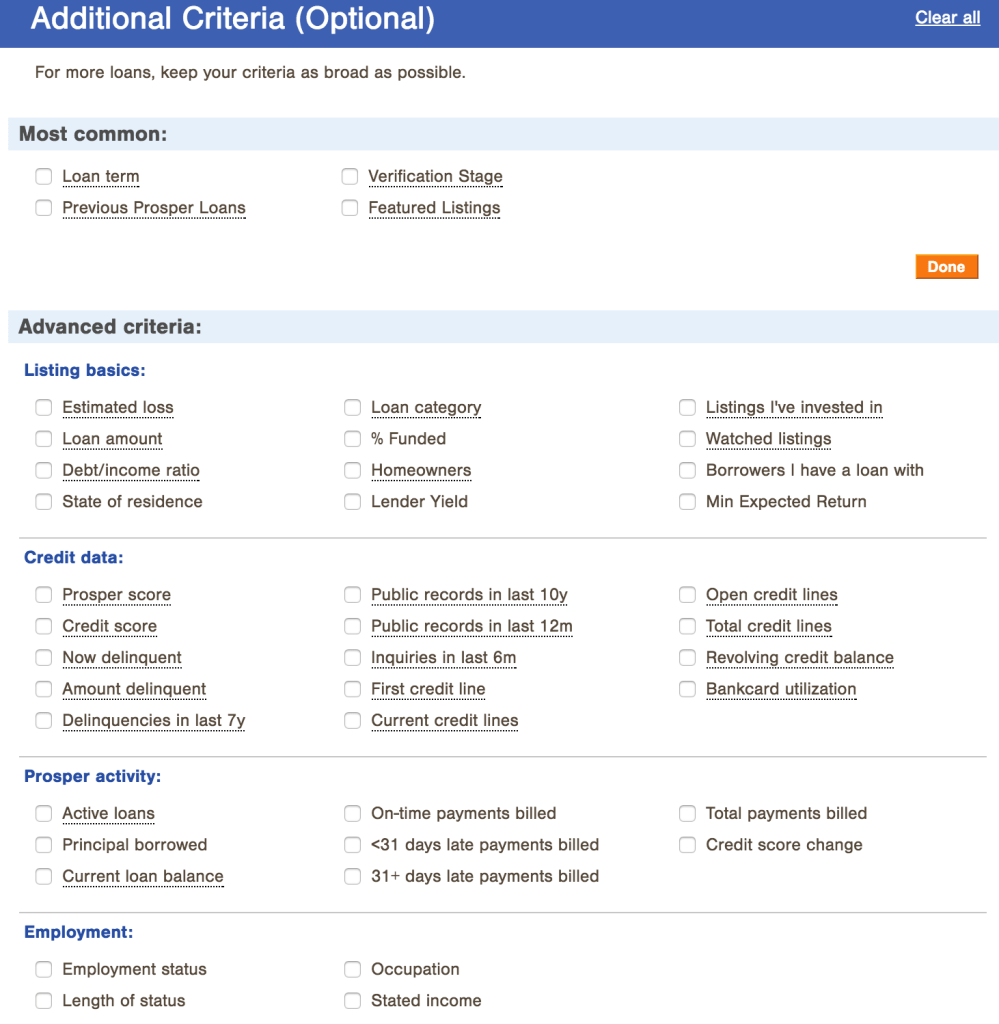

At this marketplace, borrowers request personal loans on Prosper as well as investors (individual or institutional) can fund anywhere from $2,000 to $35,000 as per loan request. Investors, on the other hand, can also consider borrowers’ credit scores, ratings, along with histories and the category of the loan. Prosper handles the servicing of the loan as well as collects and allocates borrower payments and interest back to the loan investors.

The way in which Prosper works is that you can take out a Prosper loan for either three years (36 months) or five years (60 months) with no pre-payment penalty. Interest rates in Prosper loans begin at 6.95 percent for borrowers with exceptional credit, but at times they do go up from there, to a huge rate of 35.99 percent APR maximum.

In addition to this, if you want to check your rate with Prosper then you can check it anytime deprived of affecting your credit score. One thing you must take note that if you have a consistent income and your credit score isn’t very bad, then you may possibly be able to get an unexpectedly good interest rate on a personal loan.

Applying For Prosper Loan

All thanks to quick and easy online application procedure through which one can get a loan from Prosper. One can also apply for a loan directly from the website of Prosper. Before submitting a full application, you also get the option to check your rate.

Things To Keep In Mind Before Applying For Prosper Loan:

A total number of amount you want to borrow, Your employment status, Your Social Security number, Your monthly housing costs, Your income status, Existing debts you owe along with the payments you’re making on them.

At first, you have to apply for a Prosper loan also in order to see if you might qualify for the loan and what your rate will be. At the second stage, you’ll need to set up a profile and loan request. Also, the best part here is that it will cost you nothing and there’s no obligation to finance except your loan gets funded.

Another best thing about Prosper is that it’s an auction environment, here lenders compete with each other in order to get the best loans. If they think you’re a good credit risk, your loan may possibly be funded very speedily but if not, then your loan might not get funded at all.

At last, the verification is done for this you have to submit your ID proofs and other identification proofs and that’s it you are all done!

Are there any Benefits and Downsides of Prosper Personal Loans?

Yes, there are many benefits of Prosper Personal Loans but at the same time, it also has some disadvantages too. Let’s talk about both of them:

Talking about its Benefits at first, Prosper lets the loans to borrowers who may not qualify with traditional banks.

Here you can use the funds for almost anything such as home renovation, buying a new car, paying for school fee, making big purchases, or else paying for your wedding.

Auction environment also let a possibility for better interest rates

There are also no early payoff penalties.

The best part is that even if you don’t have a perfect credit score, you can still qualify for the loan as the minimum credit score of Prosper is 640, which in other terms considered being “reasonable” credit.

Now, talking about Prosper Drawbacks, it may sometimes charge you origination fee based on credit

The maximum loan amount sometimes may not be pretty enough for some borrowers and also some of the best-qualified borrowers find the interest rates still high.

You’re limited to a three or five-year loan term as well as it takes a total of five days in order to get your funding from the time you accept your loan offer.

Final Verdict

We believe that Prosper Personal Loans very helpful as a debt consolidation marketplace for both borrowers with good credit as well as for borrowers who needs a little more flexibility in credit score necessities. One should give it a try to this amazing platform because everyone has their own preference and there might be some people who will like some features of it and the others will not. So, we will advise you to take a try at first.

![Myinstantoffer Pre Approval Loans At Myinstantoffer.com [Full Reviews]](https://nbpostgazette.com/wp-content/uploads/2019/11/Myinstantoffer-Pre-Approval-Loans-At-Myinstantoffer.com_-251x150.png)